Key Points

If you’ve spent more than five minutes in the crypto markets, you’ve likely heard the term stablecoin a gazillion times. You may have also wondered how stablecoins make money, as adverts tell you that it is possible to earn attractive APYs on these assets.

Stablecoins are designed to mirror the value of the US Dollar in most cases, although some are also pegged to other fiat currencies like the euro.

They are considered the lifeblood of the crypto market and a growing segment of it called decentralized finance (DeFi).

Stablecoins provide the liquidity needed for trading and act as a safe harbor during periods of extreme volatility, which occur every other day for cryptos.

But here is the million-dollar question: If a stablecoin is always worth exactly $1, how do the companies behind them turn a profit?

Unlike Bitcoin, which rewards miners through new coin issuance, or Ethereum, which rewards validators via transaction fees, stablecoin issuers rely on a business model that looks surprisingly like a traditional bank, but mingled with the mind-blowing efficiency of blockchain tech.

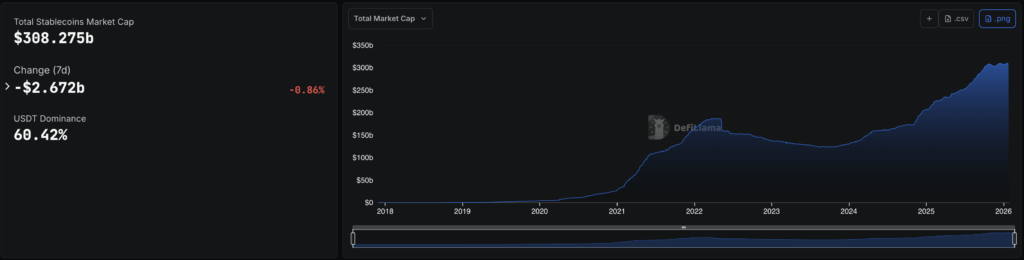

As of early 2026, the stablecoin market has surpassed the $300 billion mark in total supply. With those kinds of numbers, even the smallest yields can turn stablecoins into multi-billion dollar profit machines.

Let’s pull back the curtain on how top companies like Tether or Circle actually make money.

The “Big Three” Revenue Drivers for Fiat-Backed Stablecoins

Fiat-backed stablecoins like Tether (USDT) and USD Coin (USDC) are the heavyweights of the industry.

Their business model is elegant in its simplicity: you give them $1, they give you 1 digital token, and they “hold” your dollar safely while you do your thing.

A. Interest on Reserves (The Yield Model)

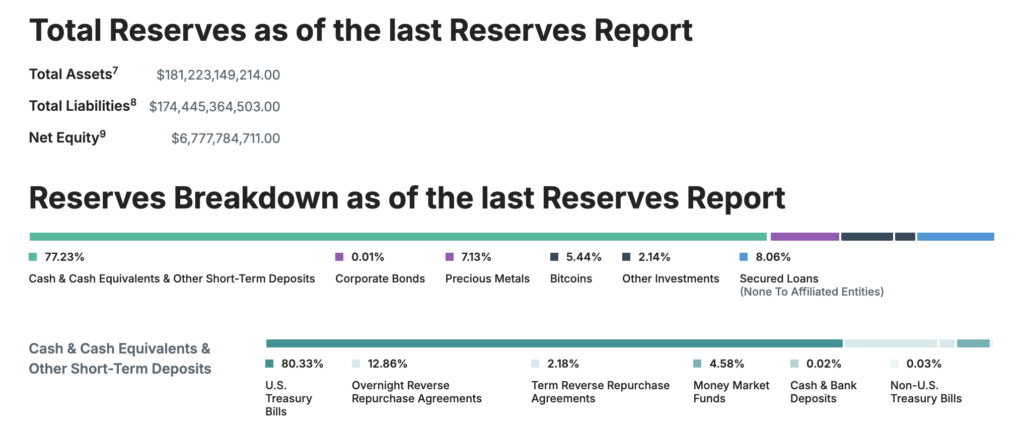

This is the main way stablecoins make money. When you send $100 million to an issuer like Circle (USDC), they don’t just keep that cash in a vault. Instead, they invest it in ultra-safe, interest-bearing assets like U.S. Treasury Bills.

In a world where 1-year T-bills yield more than 3%, an issuer holding $100 million in reserves will generate roughly $3 million per year in interest, just by holding your money.

B. Minting and Redemption Fees

While retail users usually buy stablecoins on exchanges like Binance or Coinbase, large institutions deal directly with the issuers. These issuers often charge a fee for:

- Minting: Creating new tokens from fiat.

- Redemption: Burning tokens to get fiat back.

These fees are typically small (often around 0.1%), but when you are moving billions of dollars a month, that tiny percentage adds up to few more zeroes to your bottom line.

C. Secondary Investment Gains

Finally, some issuers take a more “aggressive” approach than others.

While Circle is known for its conservative 100% cash and Treasury backing, Tether (USDT) has historically diversified a portion of its reserves into Bitcoin, gold, and even secured loans to other entities.

When the price of Bitcoin or gold rises, Tether’s “excess reserves” grow, padding their bottom line.

| Issuer | Primary Revenue Source | Secondary Revenue Source | Transparency Level |

|---|---|---|---|

| Tether (USDT) | US Treasuries & Secured Loans | Bitcoin/Gold appreciation | Quarterly Attestations |

| Circle (USDC) | US Treasuries & Cash | Transaction Service Fees | Monthly Audits |

Decentralized Stablecoins: Making Money Without a Bank

Not every stablecoin is issued by a centralized entity. Decentralized stablecoins like DAI (from MakerDAO) or USDD(from Tron DAO) use “smart contracts” to manage their reserves and maintain their peg.

This is how this kind of stablecoin makes money.

Stability Fees

When you want to “mint” DAI, you don’t send dollars to a company. Instead, you lock up collateral (like Ethereum) in a smart contract. To get your collateral back, you have to pay back the DAI plus a Stability Fee. This fee is essentially an interest rate that goes directly into the protocol’s treasury (the DAO).

Liquidation Penalties

Decentralized stablecoins are commonly “over-collateralized.” This means that, if you want to borrow $1,000 worth of DAI, you might have to lock up $1,500 worth of ETH.

If the price of ETH crashes and your collateral value drops below a certain threshold, the protocol will liquidate your position.

This means that it will automatically sell your ETH to cover the debt and charge you a “Liquidation Penalty” – often 10% to 13%. This penalty is a major revenue stream for DeFi protocols.

The Rise of “Yield-Bearing” Stablecoins

In 2025 and 2026, we have seen a shift toward stablecoins that share their wealth with users and investors.

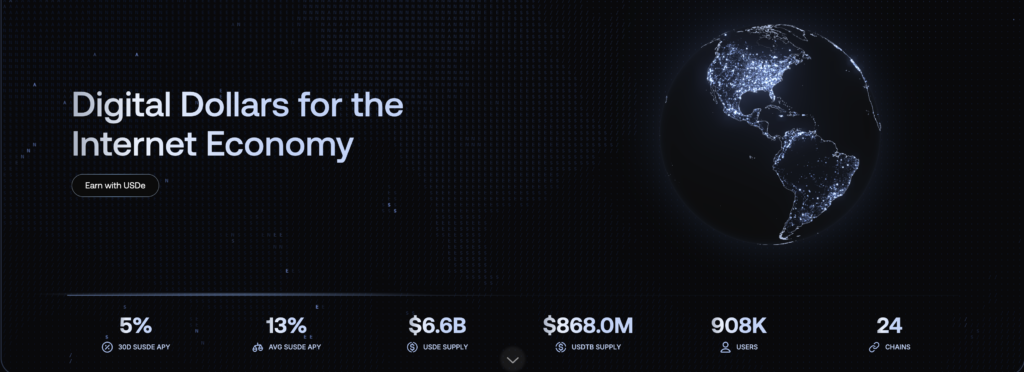

Traditional issuers like Tether keep all the interest for themselves. However, new “yield-bearing” stablecoins (like USDe by Ethena) adopted a different mechanism.

These protocols often use “Delta-Neutral” strategies. They hold staked Ethereum (which earns about a 3-4% APY) and simultaneously open a “short” position to hedge against price drops.

The funding rates from these positions, plus the staking yield, produce a “native yield” that is paid out to holders.

Note: These models are more profitable but carry higher risks, as they rely on the stability of complex derivatives markets rather than investing in low-risk government bonds.

At CryptoBites, we created a tool to keep track of the best DeFi platforms to earn yield on stablecoins.

Macroeconomic Impact: Why Stablecoins are “Shadow Banks”

To understand the scale of how these assets make money, we have to look at the macro picture. Stablecoin issuers have become some of the largest holders of US government debt in the world.

By taking “idle” cash from the crypto ecosystem and funneling it into the US Treasury market, they are essentially acting as a bridge between the traditional financial industry and the new “high-tech” version of Wall Street.

This “liquidity transformation” is exactly what traditional banks do, but stablecoins do it 24/7, without borders, and with significantly lower overhead.

Risks to the Revenue Model

No investment is without risk. For stablecoin issuers, their “money-making machine” can be threatened by a few key factors:

- Interest Rate Cuts: If the Federal Reserve drops interest rates to 0% again, the “Interest on Reserves” model evaporates. Issuers would then have to rely heavily on transaction fees or more aggressive (and risky) investments.

- Regulatory Crackdowns: New laws (like MiCA in Europe) require issuers to hold specific types of reserves and limit how they can invest them, which can compress profit margins.

- The “Bank Run”: If users lose faith in a certain issuer and try to redeem all of their tokens at once, these private companies might be forced to sell their Treasuries at a loss, potentially causing a de-pegging.

Bottom Line: Stablecoins Are A Multi-Billion Dollar Bridge

Stablecoins have evolved from simple trading tools into highly profitable financial instruments – especially for issuers.

Whether it’s through the interest they earn on billions of dollars in U.S. Treasuries or the automated liquidation penalties of a DeFi protocol, these assets have found a way to monetize “stability” in a volatile market.

As this segment of the industry keeps moving forward, we expect to see more competition between “conservative” models like USDC and “yield-sharing” models that give users a share of the profits they earn.