Key Points

If 2025 was the year of institutional acceptance via ETF launches in the United States, 2026 might be the year where explosive yield-bearing stablecoins will see rising mainstream adoption.

Investors no longer want to simply hold a stable asset – they want that asset to work for them. For that reason, we wrote this article to share with you the top 5 stablecoins to earn yield in 2026.

As of early 2026, the stablecoin market cap has surpassed the $300 billion mark, fueled by a new class of assets that bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi).

Whether you are a risk-averse saver who wants to squeeze more out of your digital assets or a DeFi native chasing the most attractive returns on your idle capital, you have plenty of options to choose from now.

5 Top Stablecoins To Earn Yield in 2026

January, 2026| Stablecoin | Top Protocol | Projected APY |

|---|

In addition to this list, you can keep track of stablecoin yields across all blockchains and protocols through our proprietary tool designed to scan the market and rank the top-yielding DeFi protocols for USDT, USDC, and USDS.

1. Tether (USDT): The Liquidity King

Despite a decade of “transparency” debates, Tether (USDT) remains the undisputed heavyweight of the stablecoin world. With a market cap exceeding $80 billion, this is the dollar-pegged stablecoin that all platforms use to list asset prices.

What’s USDT?

USDT is a fiat-backed stablecoin issued by Tether Limited. It is backed by a diversified reserve of cash, US Treasuries, Bitcoin (BTC), gold, and other assets. Its value proposition is simple: it is everywhere. If a protocol exists, it likely accepts USDT.

How to Earn Yield on USDT?

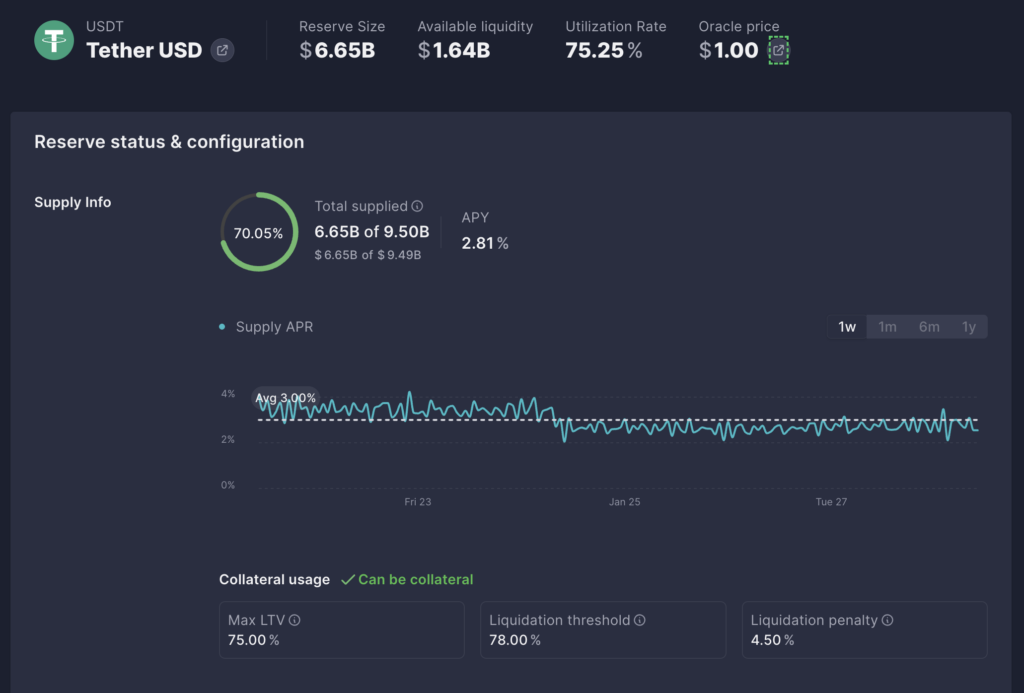

- Lending Protocols (Aave, Morpho): In 2026, USDT continues to be the most borrowed asset across protocols. You can supply USDT to decentralized lending pools where market makers and traders pay interest to borrow your liquidity.

- Centralized Earn Programs: Major exchanges like Binance continue to offer “flexible” earn products on USDT, often yielding between 5% and 11% depending on market conditions.

Why it stands out: Unmatched liquidity. You can enter and exit multi-million dollar positions without worrying about price slippage, making it the safest choice for those who value immediate access to their capital.

New users can enroll for Binance Earn by clicking the button below to earn additional USDT rewards

2. USD Coin (USDC): The Institutional Gold Standard

If you think of USDT as the top stablecoin for investors and traders, you can think of USDC as the stablecoin for “suits.”

Issued by Circle, USDC has become the primary rail for institutional cross-border payments and regulated DeFi platforms – especially in the United States.

What’s USDC?

USDC is also a reserve-backed token pegged to the U.S. dollar. However, this stablecoin fully complies with regulatory requirements in the United States.

Every token is backed 1:1 by cash and short-term US Treasuries held in segregated accounts. It is the preferred asset for BlackRock, Visa-linked payment pilots, and Coinbase.

How to Earn Yield on USDC?

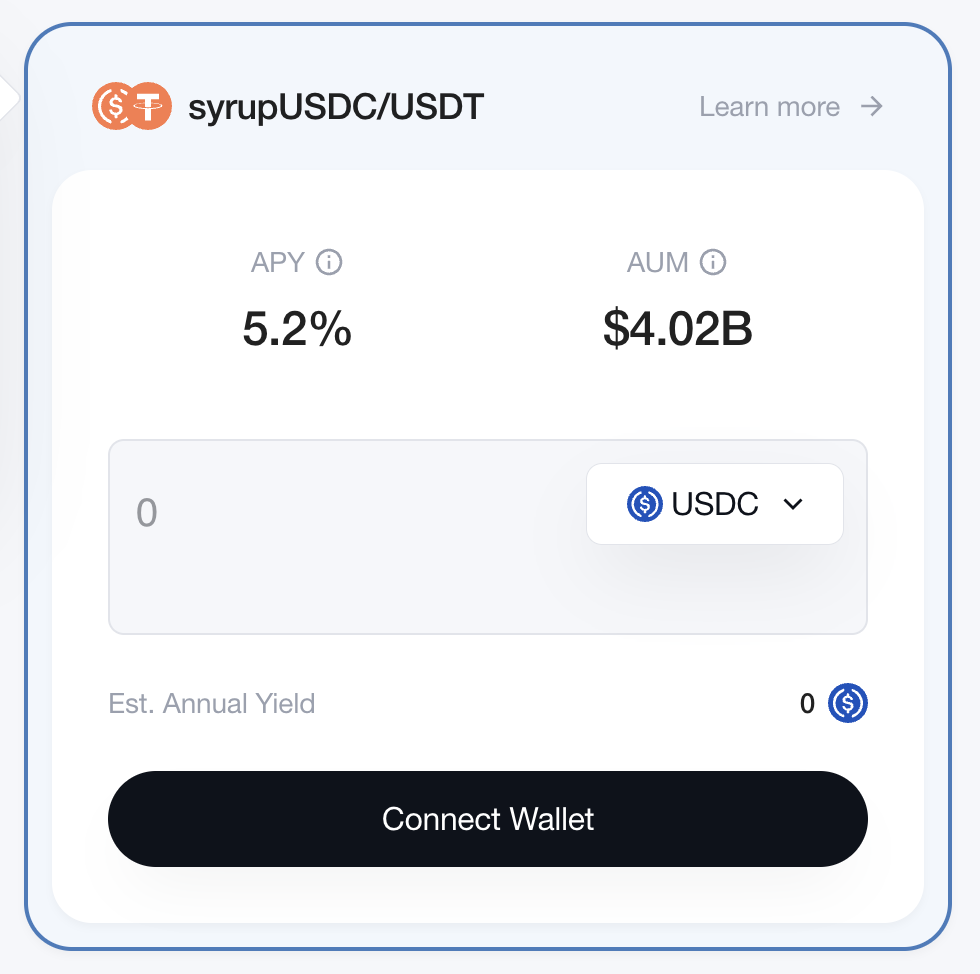

- Maple Finance: This protocol allows users to lend USDC to institutional borrowers (e.g., market makers or trading firms) in exchange for fixed yields that often outperform standard DeFi lending platforms.

- Coinbase Staking/Rewards: As a primary partner of Circle, Coinbase often provides direct “held-in-wallet” rewards for USDC holders, effectively mirroring a high-yield savings account.

Why it stands out: Stricter regulatory oversight. USDC aims to comply with U.S. regulations on stablecoin issuance and provides monthly reports on its reserves. In addition, its portfolio is made up of low-risk instruments only, while USDT includes exotic assets like gold and BTC.

USDT vs. USDC Compared

| Factor | Tether (USDT) | USD Coin (USDC) |

| Primary Yield Source | DeFi Lending / Liquidity Pools | Institutional Borrowing |

| Regulatory Status | Off-Shore / High Liquidity | U.S. Regulated / More Transparent |

| Yield Ranges in 2026 | 5% – 12% | 3.5% – 9% |

3. Ripple USD (RLUSD): The New Enterprise Contender

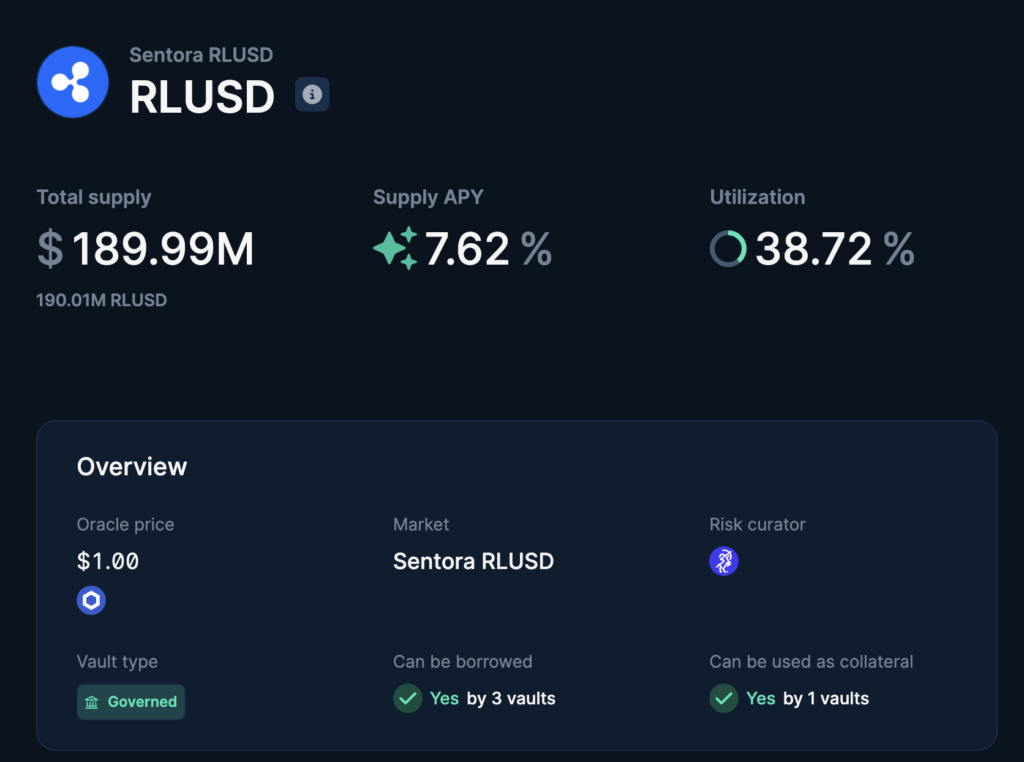

Launched into full production in 2025, Ripple’s RLUSD native stablecoin has quickly carved out a niche as the “bridge currency” for enterprise settlements.

In just a year, its market cap has jumped from $50 million to $1.3 billion. Ripple has been securing key licenses across the globe to make sure RLUSD becomes the favorite enterprise-grade stablecoin used by corporations and institutions to send cross-border payments.

What’s RLUSD?

RLUSD is a 1:1 USD-pegged stablecoin issued by Ripple Labs under a New York Trust Company Charter. It is designed to run natively on both the XRP Ledger (XRPL) and Ethereum, targeting fast and low-cost institutional settlement.

How to Earn Yield on RLUSD?

- Automated Market Makers (AMM) on XRPL: You can provide liquidity to RLUSD pairs on the XRP Ledger. Because RLUSD is used for high-frequency cross-border remittances, liquidity providers can earn attractive fees by participating in this activity.

- Euler Finance: These protocols have integrated RLUSD for “institutional DeFi” lending, allowing users to earn yield in a compliant environment.

Why it stands out: It carries the NYDFS (New York Department of Financial Services) seal of approval, making it a heavily regulated stablecoin that aims to suit the needs of large-scale institutional holders.

4. Sky Dollar (USDS): The Algorithmic Alternative

In 2025, the pioneer of decentralized stablecoins, MakerDAO, rebranded its ecosystem to Sky. Its new flagship stablecoin, USDS, is the successor to DAI, built specifically for the next era of DeFi.

What’s USDS?

USDS is a decentralized, over-collateralized stablecoin. Unlike USDT or USDC, which are managed by centralized entities, USDS is managed by the Sky Protocol. It is backed by a mix of crypto-native assets (like ETH) and Real-World Assets (RWA) like tokenized T-bills.

How to Earn Yield on USDS?

- Sky Savings Module (SSM): This is a native “staking” feature where USDS holders can lock their tokens to earn a share of the protocol’s revenue (generated from its RWA investments).

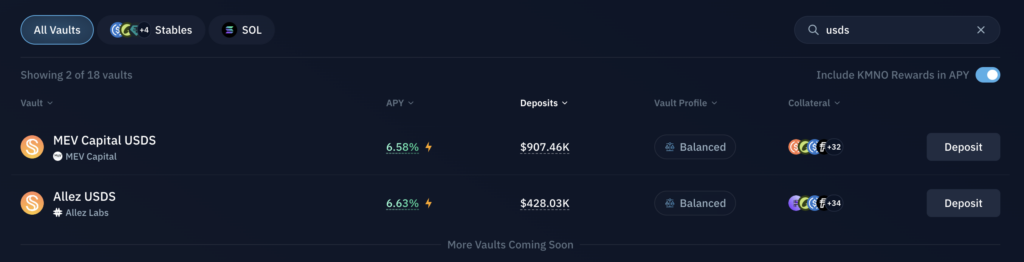

- Kamino & Solend (Solana): Although USDS is an Ethereum-native stablecoin, USDS has massive liquidity on Solana. Hence, users can earn higher yields by providing USDS to efficient lending markets like Kamino.

Why it stands out: Over-collateralized and fully decentralized. While Tether and Circle can blacklist addresses and freeze assets, Sky does not exert that kind of control on USDS. This is a strong feat that makes it the best choice for users who want to stay away from any kind of government intervention and stick to the core principles of blockchain technology.

5. Ethena (USDe): The Sophisticated Candidate

The most innovative (and perhaps controversial) entry on this list is USDe. This stablecoin doesn’t rely on banks or traditional collateral. Instead, it uses a “Delta-Neutral” strategy to create stability.

What’s USDe?

USDe is a “synthetic dollar.” The protocol holds staked Ethereum (stETH) and opens an equal-sized “short” position in the futures market.

This balances out the price movements, keeping the value of the asset at $1 while capturing two sources of yield: ETH’s staking rewards and the “funding rates” paid by traders under different market conditions.

How to Earn Yield on USDe?

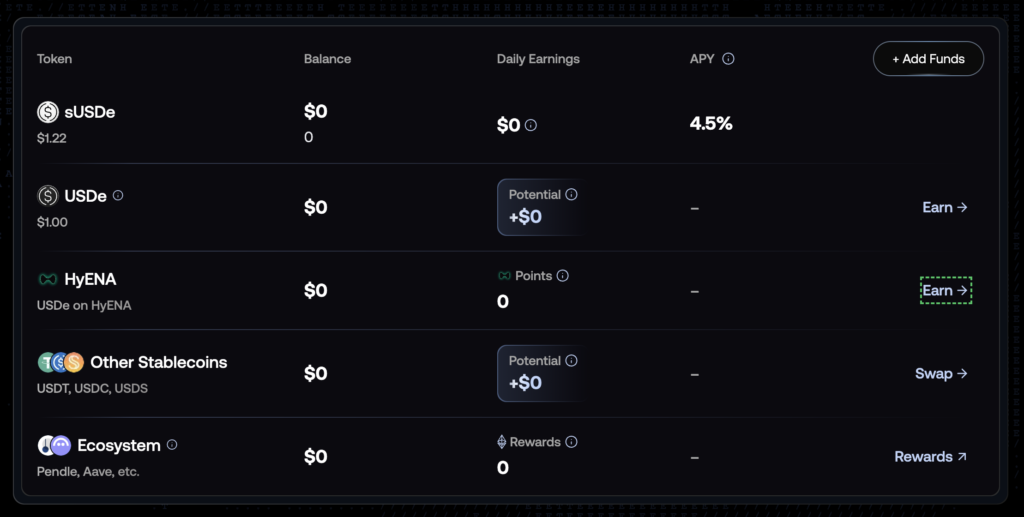

- sUSDe Staking: By staking USDe into the protocol, users receive sUSDe, which automatically accrues yield. In bullish markets, this yield has historically soared as high as 20%+, as traders pay high fees to keep their long positions on ETH open.

- Liquidity Provisioning (Curve/Convex): USDe is a staple in the “Curve Wars”, where users can lock USDe in liquidity pools to earn trading fees plus protocol incentives.

Crucial Note: USDe carries a higher risk compared to the other stable assets cited in this article. If funding rates turn negative for an extended period, the yield can disappear. In this scenario, the protocol must rely on its reserve fund to maintain the asset’s peg.

How to Choose Among These Top Stablecoins to Earn Yield in 2026?

Choosing among these top stablecoins to earn yield in 2026 requires a careful assessment of your risk tolerance and expected returns. As a rule of thumb, here’s how each of these assets could fit different types of investors.

- Safety and Transparency: Stick to USDC or RLUSD. Their yields are a bit lower, but their legal backing is the strongest.

- Utility: Use USDT. It is the “universal adapter” for the crypto world.

- Innovation: Explore USDS or USDe. These algorithmic stablecoins often offer higher returns but expose you to smart contract and design risks.

Make sure you understand how yield is generated and how the token maintains its peg before buying. In addition, you can use our dedicated “DeFi Yield Leaderboard” tool to keep track of the top DeFi yields for stablecoins across blockchains and protocols.

1 comment

[…] growth trajectory while addressing claims from Bank of America CEO Brian Moynihan that yield-bearing stablecoins could trigger massive deposit flight from commercial […]