Table of Contents

Cryptocurrency markets may trade 24/7 and operate outside the infrastructure of traditional financial systems, but that does not prevent prices from being influenced by macroeconomic data — particularly those data points that originate within the United States.

Key economic releases such as inflation data and interest rate decisions from the U.S. Federal Reserve routinely trigger sharp moves across Bitcoin (BTC) and the broader crypto market.

Understanding this relationship helps explain why crypto prices can swing violently within minutes of a U.S. data print, even when no crypto-specific news is involved.

Inflation, Interest Rates, and Liquidity Conditions

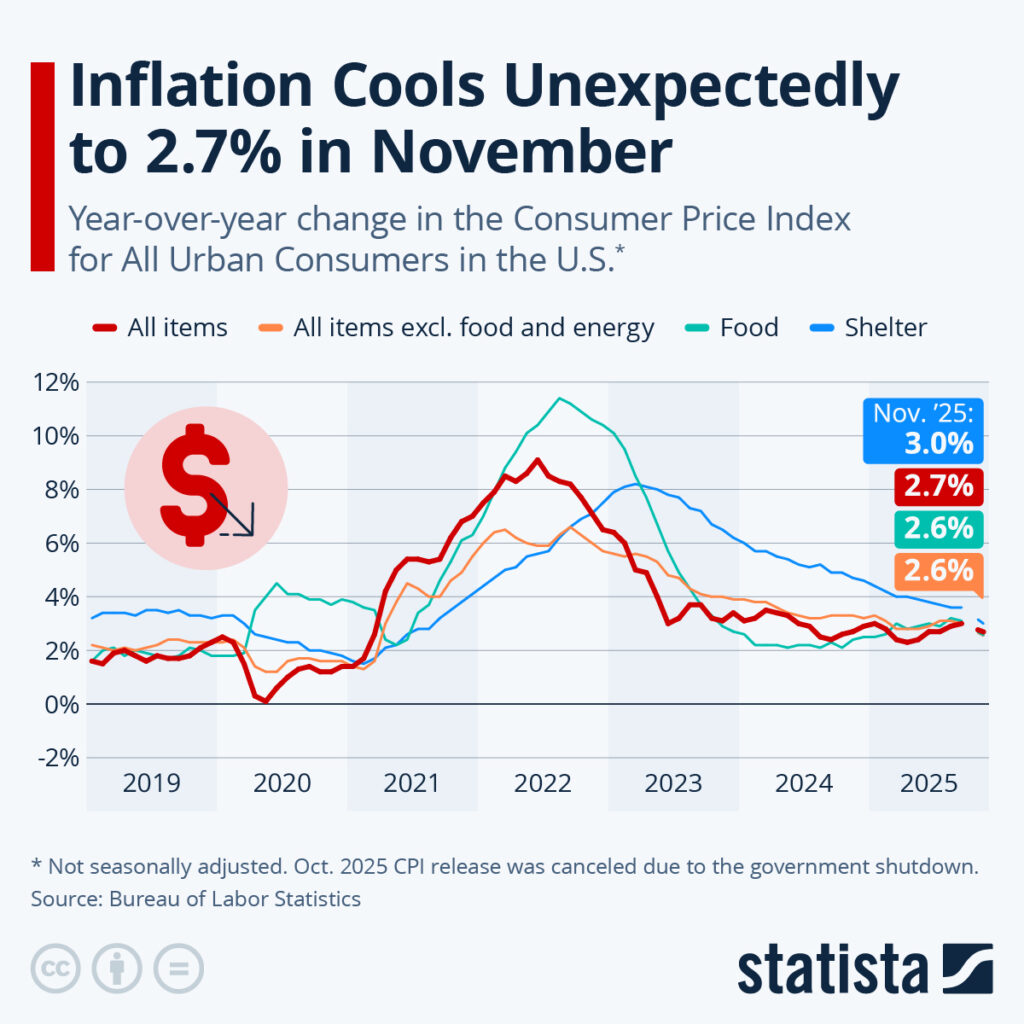

At the center of this dynamic is U.S. inflation, typically measured through the Consumer Price Index (CPI). CPI data shapes expectations around Federal Reserve policy, particularly the trajectory of interest rates.

When inflation comes in hotter than expected, the market tends to price in tighter monetary policy. Higher interest rates increase the cost of capital and reduce available liquidity — two conditions that historically weigh on speculative assets. Cryptocurrencies, which rely heavily on excess liquidity and leverage, are especially sensitive to these shifts.

Conversely, softer inflation data often fuels rallies. Lower expected rates improve liquidity conditions, encourage risk-taking, and support higher valuations across assets that benefit from capital inflows. In crypto, this effect is often amplified due to thinner order books and leveraged trading.

Risk-On vs. Risk-Off Behavior in Crypto Markets

Cryptocurrencies have firmly positioned themselves within the global risk-on/risk-off framework. During periods of economic optimism, easing financial conditions, or accommodative central bank policies, investors are more willing to allocate capital to higher-risk assets, including digital ones.

In risk-off environments — characterized by rising yields, tightening financial conditions, or economic uncertainty — capital tends to rotate into safer assets such as U.S. Treasuries or cash. Crypto markets typically experience outflows during these phases, leading to increased volatility and sharper drawdowns than those seen in traditional equities.

This behavior underscores an important reality: despite its decentralized narrative, cryptos trade more like a high-beta asset than a defensive hedge during most macro cycles.

Bitcoin’s Role as a Macro-Sensitive Asset

Bitcoin, in particular, has evolved to become a highly macro-sensitive instrument. Institutional participation has increased its correlation with traditional markets, especially U.S. tech equities. Futures markets, exchange-traded funds (ETFs), and custody solutions have made BTC more accessible to macro-focused investors, further integrating it into the broader financial system.

As a result, Bitcoin often reacts immediately to economic surprises within the United States. A shift in rate expectations can change positioning across multiple asset classes simultaneously, and Bitcoin has become a part of that equation.

That said, the top crypto still retains some unique characteristics. While it behaves like a risk asset in the short to medium term, longer-term narratives around scarcity, monetary debasement, and decentralization continue to influence strategic positioning — particularly during periods of prolonged monetary easing.

This explains why its performance has outpaced that of virtually every financial asset in the world over the past 10 years.

The Bigger Picture for Crypto Investors

Strong reactions to U.S. economic data are not an inherent weakness of crypto markets. Instead, they are a reflection of their growing maturity and integration with the global financial system.

As long as liquidity, leverage, and institutional capital remain key drivers, macroeconomic data will continue to play an important role in shaping crypto’s price action.